Community Revitalization Tax Incentive (79-E)

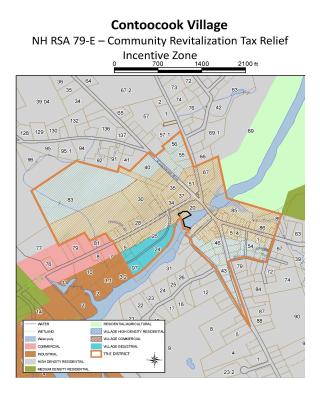

At its Town Meeting in 2009, The Town of Hopkinton adopted the Community Revitalization Tax Incentive Plan.

The purpose of this legislation is to encourage investment in central business districts, neighborhood business districts, downtowns, and village centers.

The goal is to encourage the rehabilitation and active reuse of under-utilized buildings in order to promote strong local economies and smart, sustainable growth, as an alternative to sprawl.

Therefore, a property owner who wants to replace or substantially rehabilitate a building located in a designated district may apply to the local governing body for a period of temporary property tax relief.

- The temporary tax relief, if granted, would consist of a set period of time (between 1-5 years) during which the property tax on the structure would not increase as a result of its substantial rehabilitation. In exchange for the relief, the property owner grants a covenant ensuring there is a public benefit to the rehabilitation.

- Following expiration of the finite tax relief period, the structure would be taxed at its full market value taking into account the rehabilitation.

- The rehabilitation must cost at least 15% of the building’s pre-rehab assessed value, or $75,000, whichever is less.

The rehabilitation is consistent with the municipality’s master plan or development regulations.

The documents linked below contain everything you need to complete your application for tax relief to revitalize your building. Please contact Hopkinton's Economic Development Director, Anna Wells, with any questions or for assistance.

- NH Preservation Alliance 79-E Resources

- Plymouth State University Report on 79-E: A Tool for Your Town: New Hampshire's Community Revitalization Tax Relief Incentive

- Town of Hopkinton's Community Revitalization Tax Incentive Information & Application Packet

- Text of RSA Chapter 79-E: Community Revitalization Tax Relief Incentive

| Attachment | Size |

|---|---|

| 2.55 MB | |

| 2 MB |